Apply For A Loan Today

Tell us some basic details about your project below and let us work on structuring the best loan for you. We value your time and will reach back out to you shortly!

Hard money loans in Texas

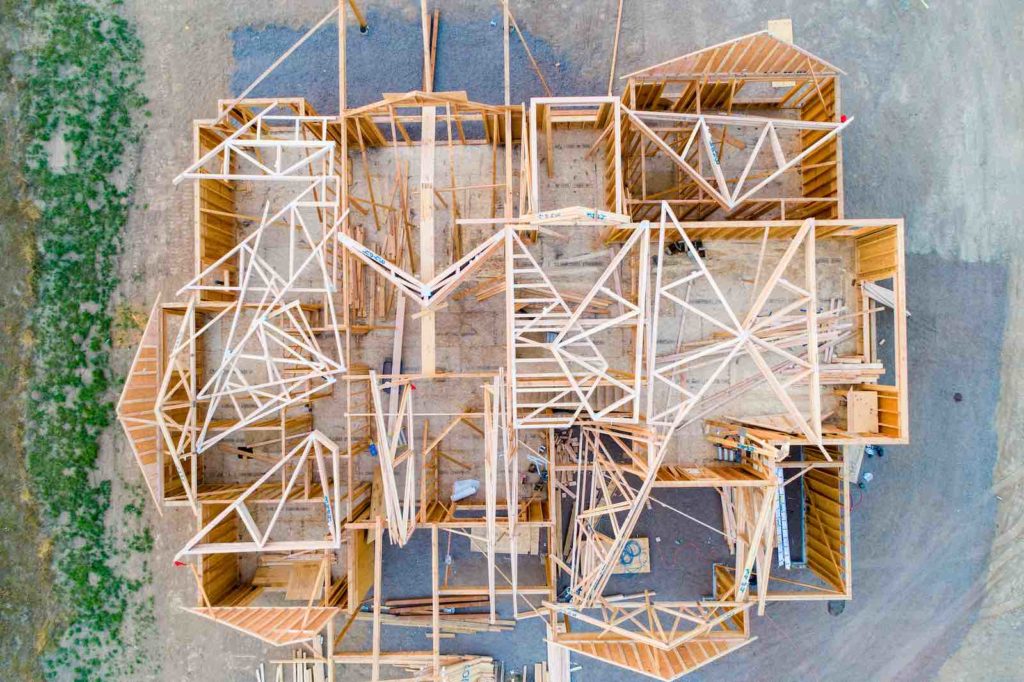

Whether you just can’t find a house that suits your needs (houses aren’t staying on the market long these days, especially in Texas), or you’ve always wanted to build and it’s finally time—you may find yourself in the market for a construction loan. Few people have the capital to start building without one.

But a construction loan is different from a traditional mortgage, which means the qualifications are different as well. The requirements for a construction loan include:

The first requirement for every traditional lender is proof that you’re working with a qualified, experienced builder. The lender will want to see a portfolio of some of the builder’s projects, as well as a profit and loss statement.

If you intend to work with a new contractor, or build the home yourself, you will need to apply for an “owner-builder” construction loan, but you will have a much harder time getting approved for that loan.

This is often referred to as your “blue book,” and it provides the lender with:

You will iron out many of these details as you work with the builder, so make sure to keep all of this information well-organized.

A construction loan requires a much higher down payment than a traditional mortgage, because there’s no house (yet) to offer the lender as collateral.

A 20% down payment is standard for traditional construction loans, although some lenders will ask for as much as 25% down. They want to know that you’re seriously invested in the project, and are not going to jump ship if complications arise.

It may seem odd to appraise a house that does not yet exist, but it’s how you qualify for a construction loan. The lender’s appraiser will look at three considerations:

Most construction loan lenders will ask for up to three years of tax returns, proof of income, and your credit score. Some will also require bank statements. Home construction can be a long process, and the lender needs assurance that you will be able to make payments as the project progresses.

In addition to a traditional construction loan, your project might be a good fit for a hard money loan. A hard money loan is financed by private lenders (rather than banks or traditional institutions), and backed by real estate (rather than the borrower’s private assets or credit). A hard money construction loan is a hard money loan given to build or renovate a property.

There are several situations wherein you might want to consider a hard money construction loan over a traditional construction loan:

The requirements for a hard money construction loan are generally less intense than a traditional construction loan.

| Traditional Construction Loan Requirements | Hard Money Construction Loan Requirements | |

| Builder | Qualified builder required | Qualified builder required |

| Plans | Blue book | Blue book |

| Down Payment | Average 20-25% | Average 10% |

| Appraisal | Required | Required |

| Financial Statements | – Tax returns – Proof of income – Credit score – Bank statements | – Proof of income |

There are a few different types of construction loans, but they all require the same basic qualifications. Remember that it’s better to be over-prepared when you go for a loan: the whole idea is that you’re trying to convince the lender that you’re a safe investment.

And if you’re working on an investment property, or just want to move faster, consider a hard money construction loan instead. If you’re in Texas, there’s no need to pre-qualify and you can apply right now.

However you plan to secure funds for your dream home, the first step is to find a qualified builder, so start reading reviews and asking local specialists. If you have a lender in mind that you’d like to work with, you might even start by asking if they have preferred builders.

Tell us some basic details about your project below and let us work on structuring the best loan for you. We value your time and will reach back out to you shortly!