Resource Center

Learn all about hard money lending, flipping houses, construction loans, and more.

HARD MONEY

Get all the information you need to determine if a hard money loan is the right fit for you, how it works, how to get approved, and more.

What is hard money?

Hard money is a loan financing option provided by private lenders and backed by assets, rather than the borrower’s credit. Learn the pros and cons, how it works, and more. →

FIX AND FLIP

Whether you’re an experienced flipper or just getting started, discover tips and insights to get quick funding, work more efficiently, and improve your ROI.

What are Fix and Flip Loans?

Conventional mortgages were designed for long-term residences, which makes them ill-suited to investment property loans. Learn how fix and flip loans were designed to fill that gap. →

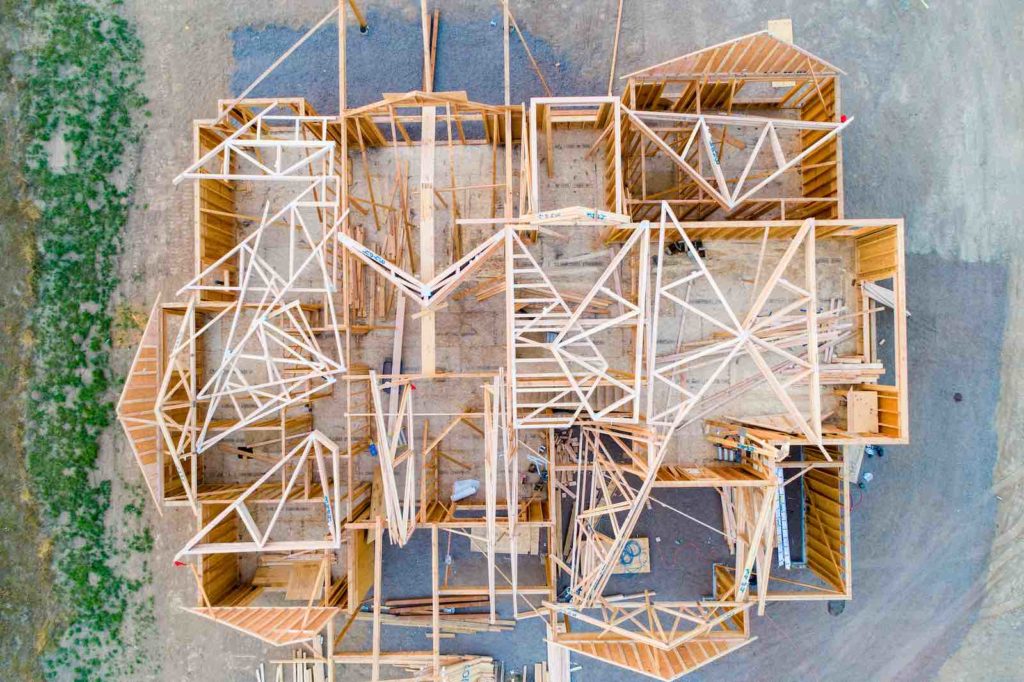

CONSTRUCTION LOANS

Construction is on the rise, which can mean greater competition for funding. Learn about construction loans to make sure you can get the financing your projects need.

What You Need to Know About Construction Loans

Understanding the construction loan process makes it easier, faster, and less painful to obtain the funds you need to move forward. Learn how the lending process for a construction loan is different from a traditional mortgage. →

ADDITIONAL REAL ESTATE AND INVESTING

Wholesale Real Estate: A Beginner’s Guide

Discover if wholesale real estate is a good investment strategy for you and how to get started.

Learn more →

How to Become a Real Estate Investor

Learn about active and passive real estate investment strategies and how to get started.

Learn more →