[Updated September 2020]

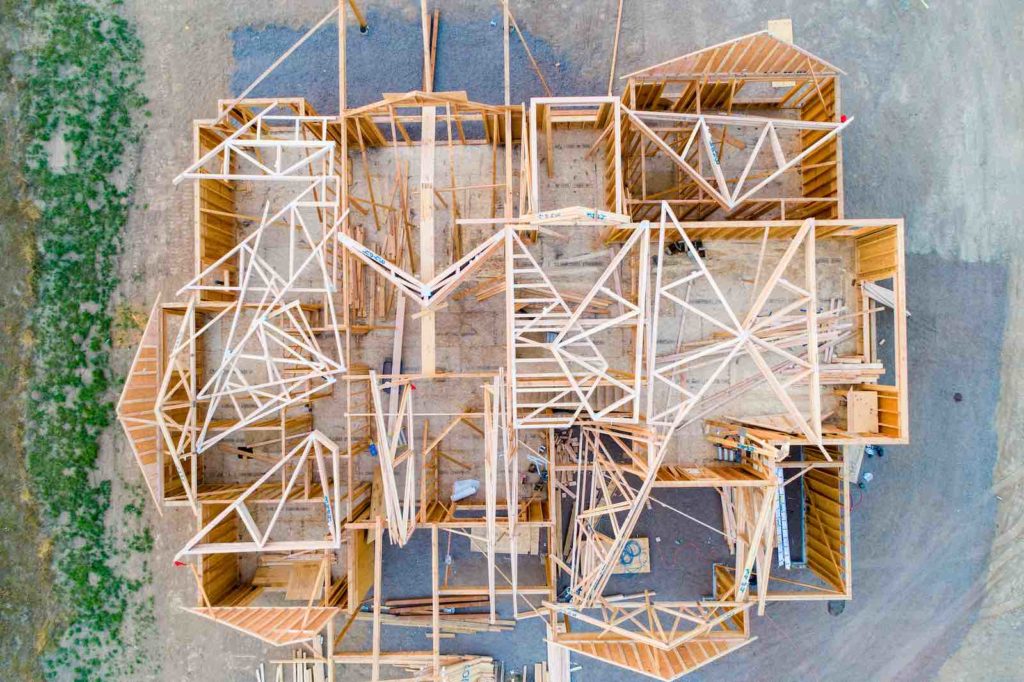

Do you have a property that you want to add on to? Or maybe you have land that you want to develop. In either case, a construction loan is the best way to finance this type of project.

The lending process for a construction loan is different from a traditional mortgage, however. Understanding the construction loan process makes it easier, faster, and less painful to obtain the funds you need to move forward.

What is a construction loan?

A construction loan is a loan designed for building or renovating a residential property. Construction loans generally have shorter terms and higher interest rates than a standard mortgage.

When construction is complete, a construction loan needs to be paid off or converted to a standard mortgage. Most standard construction loans are intended to assist the homeowner, and are not available to real estate investors.

How do construction loans work?

Lenders take extra precautions with construction loans, because, unlike a traditional mortgage, there is no house (yet) to serve as collateral. So while interest rates slide a bit, like any other loan, you will see higher numbers than on a traditional mortgage. You can expect to see interest rates that range from Prime plus 2% to LIBOR (London Interbank Offered Rate) plus 6%, depending upon the lender, the project, and the exposure.

Getting a construction loan also requires more prep work from the borrower. Not only will you need to provide the usual financial information, the lender will want to see:

- Construction plans

- Cost estimates

- A building schedule

They may even want to approve the builder that you’re using before agreeing to any kind of loan.

Once a loan is approved, you’ll get a “draw” schedule. A draw is simply a payment installment from the approved loan amount. Construction loans don’t pay out lump sums, and they don’t make payments to the borrower. At each stage of construction, the lender’s inspector will review building progress and approve the next draw to be paid directly to the builder, for the next phase of construction.

Finally, most construction loans allow the borrower to pay only interest during the life of the loan. Some construction loans can be converted into a standard mortgage when construction is complete, or when the loan term is over. Others need to be paid off through sale of the property or refinancing.

4 types of construction loans

There are a few standard types of construction loans to be familiar with if you’re thinking about building your next home.

1. Construction-to-permanent loans

A construction-to-permanent loan is a construction loan that rolls over into a traditional mortgage at the end of the construction loan term, without refinancing or a second closing. This saves you the second set of closing costs and locks in interest rates for your 15 or 13-year mortgage, so it is a great option if you’re building your primary residence.

2. Construction-only loans

A construction-only loan (also known as a “stand-alone” construction loan or a “two close” construction loan) is just the short-term loan to cover construction or renovation. The term is usually one year or less, and it needs to be paid off at the end of that term.

Construction-only loans are the obvious choice (as far as conventional loans go) for building or renovating a property that the borrower intends to sell quickly. They are also sometimes preferred if the borrower has a lot of cash on hand to work with, and wants to shop around for the best long-term mortgage lender while the house is being built.

3. Renovation loans

Renovation loans are smaller loans that are designed to help homeowners take care of cosmetic or structural repairs, usually to their primary residences. These don’t require construction plans or schedules for approval, but are still more uniform than other small financing options, like a HELOC.

Renovation loans can also be wrapped into a mortgage at closing, if you fall in love with a fixer-upper.

There are three main types of standard renovation loans: the FHA’s 203(k) loan, Fannie Mae’s HomeStyle loan, and the Freddie Mac CHOICErenovation loan. They all cover most major or minor home renovation projects. The 203(k) can only be used on a primary residence.

4. Owner-builder construction loans

An owner-builder construction loan is essentially a construction-only loan, but where the borrower is also the builder. While being your own general contractor can potentially save some money on construction, most traditional lenders will only agree to an owner-builder construction loan if the borrower is a licensed, experienced builder.

What about an “end loan”?

The term “end loan” is just another term for the standard mortgage that a borrower uses to pay off a construction-only loan.

Hard Money Construction Loans vs. Traditional Construction Loans

A hard money loan is one financed by private lenders or individuals, rather than banks or traditional institutions, and backed by real estate, rather than the borrower’s private assets or credit. A hard money construction loan is a hard money loan given to build or renovate a property.

Hard money loans offer several benefits:

- Faster closing — New construction requires a substantial amount of documentation and form-filling with a traditional loan program. Because hard money loans are private investments, lenders have more flexibility. Hard money construction loans might take a bit longer than a traditional hard money loan, but you can still potentially have funds within a week or two.

- Faster draws — Because hard money construction loans are more flexible, construction draws are often easier and faster as well.

- Flexible terms — Hard money lenders aren’t restricted by the one-size-fits-all requirements of a big financial institution. They can take each case individually and decide who they want to work with.

Additionally, hard money fix and flip loans were designed specifically for purchasing, renovation, and selling investment properties. So if you’re looking for financing to flip a property, a traditional construction loan—even a renovation loan—may prove to be more of a hassle than it needs to be.

What does a construction loan cover?

Construction loan funds generally cover purchase of property, permits and fees, material expenses and labor, and closing costs. The same is true for hard money construction loans.

How to choose a construction loan lender

Find a few traditional lenders who offer construction loans (not every mortgage lender does) and one or two hard money lenders, so you can really compare all of your options. Look at factors like:

- Construction lending experience

- Loan rates

- Loan terms

- Down payment requirements

- Construction draw requirements

- Qualification requirements

You might also want to consider the lender’s physical location. National lenders are fine for many situations, but there are benefits to partnering with a local lender too—especially for hard money construction loans.

A local lender will have knowledge of the area, local real estate markets, and local builders and contractors. Smaller, local offices generally get to know their borrowers well, and provide better service to borrowers that they consider partners in local real estate.

How to get a construction loan

Once you’ve chosen an ideal lender, start by getting pre-qualified if necessary. You don’t want to get blueprints finalized only to realize you don’t qualify. (Of course, if you’re working with a hard money lender, this generally isn’t an issue.)

Lender Documentation Requirements

While each lender has specific requirements, there are some fundamental documents that you will need with just about any lender:

- Architectural drawings or building plans outlining what is being developed.

- Contract to purchase or other documentation showing that you own or will own the subject property.

- Cost estimate of the scope of work that is being done, detailed by line item.

- Timeline of proposed construction. This is not the time to assume everything will go smoothly; it won’t. So make sure that you have a bit of a cushion in your timeline for areas that slip off schedule.

- Up to three years of prior tax forms and a current financial statement. Some lenders will ask for bank statements as well. The objective here is to provide more than sufficient information for the lender to be comfortable with your ability to make the loan payments during the lending period.

- Appraisal and possibly a survey of the property prior to loan approval or disbursement of any funds.

What to Expect

Once you’ve provided the project scope and schedule, the lender will create a draw schedule. Loan proceeds are disbursed based on the agreed upon schedule. Depending upon the scope of the project, there are usually somewhere between three to eight draws allowed.

Pay careful attention to how you will receive the draws. All too often borrowers find that they need to pay out of pocket or request modifications to the draw schedule because there are shortfalls in costs that need to be paid. This is where having a good relationship with your lender is critical!

This type of loan requires a much larger down payment than the as-low-as 3% that you might find when purchasing an existing home. Construction lenders will usually require a minimum of 20% down payment.

How to get a hard money construction loan

The good news is that you don’t need to prequalify and you don’t need to provide tax returns. Hard money lenders will still want to see most of the same plans, however. You’ll also need to make sure to have a down payment ready; most hard money lenders require at least a 10% down payment on the loan.

If you’re building in Texas, you can apply right now.

Construction Loans 101 and Hard Money Construction Loans in Texas

If you just can’t seem to find the perfect home, and you’re thinking of building, there are lots of financing options available—but construction loans are much different from standard mortgages. Be sure you know what to expect. And be sure to compare the four standard types of construction loans against hard money construction loans as well, to explore all your options.

If you’re not sure where to build, come visit Texas! In 2019, Austin was ranked the #1 U.S. city to live in for the third consecutive year. It wasn’t the only Texas neighborhood to make the list. Texas communities routinely make the short lists for the best places to live and build all across the country.

Finally, if you’re in Texas and exploring options to build, get in touch to see how Loan Ranger can help!

1 thought on “What You Need to Know About Construction Loans”

Comments are closed.