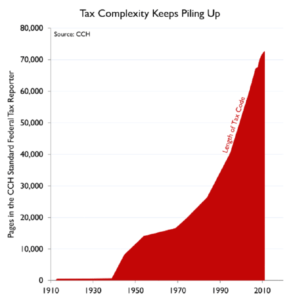

With tax season now a month behind us we can all breathe a sigh of relief. Depending on your financial situation and portfolio composition, this can be a stressful time of year as you are digging through documents to make sure you include every single deduction you possibly can. We have to consider interest paid on hard money loans, real estate held, and what type of capital gain to claim on that fix and flip investment. While we all scramble to get this done on time and minimize the amount we owe, how many people have even read the tax code in its entirety? If you haven’t, like nearly the entire population, don’t feel guilty because the current version tax code is roughly 4 million words. To put this into perspective, consider that the Bible (both New and Old Testament) is 788,280 words, meaning the United States Tax Code is more than five times longer than the Bible!

Of course this wasn’t always the case. Up until about 1940, the tax code was actually fairly manageable. As you can see on the graph above, it has grown longer just about every year with rapid exponential growth starting in 1970.

Because of this, having a knowledgeable CPA or a well thought out tax strategy can be just as important as your actual investment selection. After all, the highest income tax bracket is 39.6% for Federal. Luckily, here in Texas we don’t have a state income tax. For our California investors paying in excess of 10% in state taxes… I really feel your pain. However, while we loathe paying taxes, it’s actually much better than getting a refund. Sounds crazy but stick with me here. When you receive a tax refund at the end of the year, you’ve essentially granted the government an interest free loan for the year. Considering that you could have had that capital earning you money the whole time, it’s a real cost to your bottom line. As real estate investors you understand that you could have used this to buy a property, do a fix and flip, or anything that would’ve made you money in the mean time. If you are receiving a sizable refund this year, I’d highly recommend you consider decreasing the amount withheld from your pay.

So other than be “happy” we’re paying taxes instead of getting a refund, what can we do? This is where having a well thought out tax strategy comes into play so you can minimize what you owe. After all, “It’s not about what you make, but about what you keep.”

To build on this thinking, here are a few tax strategies you may want to discuss with your tax adviser:

Focus on Asset Location – Where you keep your investments has a huge effect on taxation. While there are many vehicles to keep your assets, for the sake of this article I’ll only discuss owning in a tax deferred account (i.e. 401k, IRA, etc…) vs. owning personally. A tax deferred account will accumulate tax free until you liquidate the investments at a later date, meaning you won’t have an annual tax bill on your gains. You may want to consider keeping investments which turnover frequently and/or those which are taxed at the ordinary income tax rate in this type of account. Investments that turnover frequently, such as many mutual funds, will realize gains any time one of its components is traded, triggering the much higher short term capital gains rate. However, even with this great benefit, you likely don’t want all of your investments in a tax deferred account. First, if you have a liquidity need, the cost of removing funds early is very high (this typically applies if you remove before the age of 59½) as there are substantial penalties. You also don’t want to place an investment taxable at long term gains in a tax advantaged account as you may inadvertently trigger the higher ordinary income tax rate when you sell.

Tax Loss Harvesting – Tax loss harvesting is the practice of selling an investment that has experienced a decrease in value. Although it seems counter-intuitive to sell low, by “harvesting” this loss you can lower your taxable income and ultimately your taxes paid. By getting rid of a perpetual loser and replacing it with a new investment, you will end up with more money at the end of the day with the new appreciation and taxes saved.

Plan Ahead – Regardless of your plans for wealth succession, there are many factors you may want to consider. Depending on what you intend to pass on, you may leave your heir with a much lower amount than intended due to hefty estate taxes. If you pass down an asset which is not intended to be liquidated, such as a home for one of your children, the heir might have their own financial hardship simply finding the funds to pay the estate taxes associated with it. For these situations, life insurance could be a viable solution to ensure estate taxes are taken care of. This will help make sure your heirs don’t have the added stress of figuring out how to pay the large taxes associated with inherited assets.

While we always advise consulting a tax professional, I thought some of these may be something helpful you want to consider speaking with them about. It can be a stressful time of year but having a strategy can go a long way towards keeping more of your hard earned money in your pocket. Thank you for following Loan Ranger Capital and as always feel free to reach out with any questions.