Fast Hard Money: Why Hard Money Are so Quick

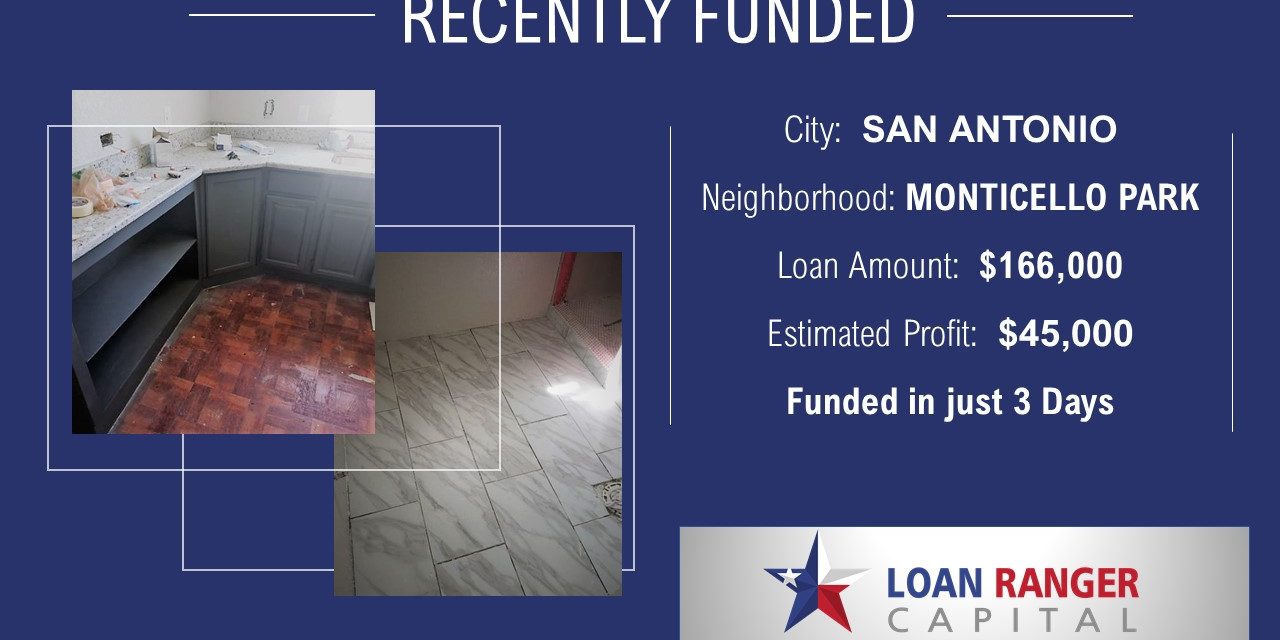

For real estate investors looking to demolish and rebuild an existing structure or start new construction, hard money construction loans offer a quick and effective financing solution. These loans, typically short-term (under 12 months), can be approved and funded in just a few days, unlike traditional bank loans. Why Hard Money Construction Loans Are So Fast Asset-Focused Lending The speed … Read more